ARCHIVE 2

Evaluating the Alternatives (November 2004)

Explains one of the greatest fallacies of investing — the belief that investing is a game of outguessing the markets. With predictions of weak returns, can stock pickers, market timers and hedge funds pick up the slack? Reviews strategies for the disciplined investor, including security selection, dynamic reallocation across sectors, styles and asset classes and hedge funds.

What’s all the Fuss about Interest Rates? (May 2004)

Discussion of Federal Reserve interest rate policy as of the current time, with background on the Federal Funds Rate and other important interest rate benchmarks. Looks at ways investors may reduce portfolio risk in anticipation of interest rate increases.

Lessons from the House of Morgan (February 2004)

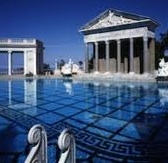

Discussion of strategies for building portfolios to withstand financial shocks, with comparisons to the work of Julia Morgan, who designed Hearst Castle by making important and innovative decisions applying technology and methodology to bolster the internal structure to withstand shocks. Explains how investors can take proven, disciplined, steps to improve the soundness of their portfolios, while remaining in the market for the long term growth that it yields.

How Good Was It? (January 2004)

This note summarizes market in 2003 with historical data and comparison to the markets and the economy from the period of the Great Depression through to World War II. Reveals how investors seeking long-term gains can obtain the results they seek if they establish and maintain the equity market exposure they need while building into their portfolios the allocation and diversification disciplines necessary to moderate and control their risks.

More on the Hidden Costs of Investing (December 2003)

General discussion of the drag that excessive costs can place on investment performance. In this note, Dr. Tiemann examines some of the costs, explicit and hidden, you pay in your investment program. Looks at how the trading costs in portfolios of individual securities and sales charges for mutual funds become an important factor in overall returns. Why investors need to be cost-conscious by understanding how investments are designed, built and sold, or risk paying too much.

Why the Mutual Fund Scandal Matters (November 2003)

An analysis of an investigation by New York State Attorney General, Eliot Spitzer, investigating the practices of certain mutual funds that were alleged to be allowing certain hedge funds to place late orders to trade in mutual fund shares to act on news that had previously happened, allowing them to buy or sell mutual funds at the days end price after the close of the market. Dr, Tiemann explains how the charges of “late trading” and “market timing” permit privileged investors to have more than their fair share at the expense of ordinary fund holders.

TIPS for your Bond Portfolio (September 2003)

General background on TIPS (Treasury Inflation-Protected Securities) U.S. Treasury Bonds whose payouts are indexed to the Consumer Price Index. This note examines how TIPS work, their advantage over ordinary Treasuries, potential risks and tax implications.