Can entrepreneurs working on innovations in nuclear energy raise venture capital in today’s market?

This is the topic that Valerie Gardner, TIA’s cofounder and principal, addressed together with James Magowan, founder of Arboreal Capital, at a session of the 2019 Nuclear Innovation Bootcamp that was held in Paris, France on August 28th, 2019. Ms. Gardner and Mr. Magowan were both invited to speak at this session on venture capital after they had presented at the US Nuclear Infrastructure Council’s first-ever New Nuclear Capital Conference, held July 16th and 17th in Washington, DC.

Addressing a roomful of young nuclear engineers (via video links), many of whom were still working on graduate or Ph.D. degrees and some now in their early career years, Ms. Gardner and Mr. Magowan reviewed both the reasons why nuclear innovation increasingly appeals to investors—particularly as the urgency to address climate change increases pressures on utilities and political leaders—and why there are steep challenges that must be met by the entrepreneurs if they hope to succeed in closing on venture funding.

While venture capital investors are always seeking the next big thing to invest their risk capital in, especially when it involves major transitions that potentially open up enormous new markets, and are therefore willing to take on a certain amount of start-up risk, in fact they are generally reluctant to assume terrifying levels of risk. Thus, it is important for companies seeking venture funding for nuclear innovation to take as many of the risks off the table before they approach venture investors.

Accordingly, it would be wise for such entrepreneurs to not leap right away into a start-up venture but actually take some time to build their resumes and networks, to spend time learning about the nuclear industry and/or the energy industry on “someone else’s dime,” and really figure out how to meet a need that exists in the marketplace with a form of innovation that will provide a unique and competitive solution. It is vitally important that the entrepreneur be able to articulate their vision and mission clearly and succinctly—as this helps the investor know that they are clear about their business.

While it is true that innovating in nuclear energy will require a longer development runway because of the regulatory hurdles required to have new designs tested and vetted by the regulators, there is a growing recognition by energy investors that what is needed for such ventures is more patient capital. The duration of the investment can then be offset by non-dilutive funding obtained through public-private partnerships, such as being developed by the Department of Energy’s GAIN program and other Office of Nuclear Energy sources of funding, and the time risk compensated with the prospect of having a product that competes handily with fossil fuels as the energy source for the remainder of the 21st century.

“The key to making great investments is to assume that the past is wrong, and to do something that’s not part of the past, to something entirely differently.” –Donald Valentine

“The key to making great investments is to assume that the past is wrong, and to do something that’s not part of the past, to something entirely differently.” –Donald Valentine

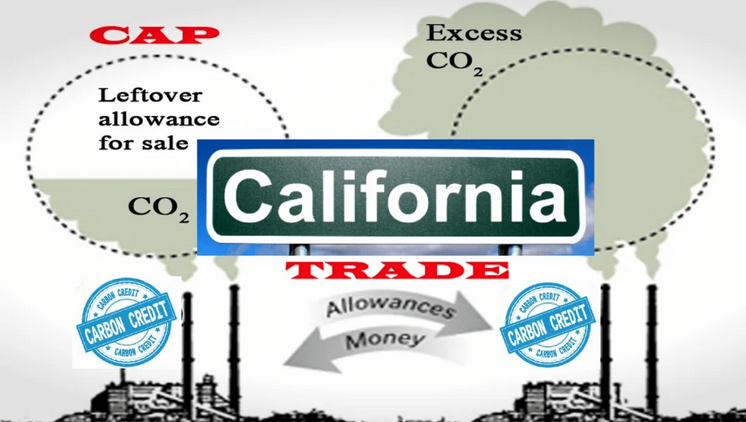

These and a number of other bases for optimism with respect to advanced nuclear entrepreneurs’ prospects for raising capital were covered, including a review of the growing area of Cleantech/ESG investments, over the course of the discussion.

Click the image to the right to download the public version of the presentation slides for the Nuclear Innovation Bootcamp “Discussion of Venture Capital.”

Leave A Comment