SEC Issues Trailblazing Climate Disclosure Proposal

At long last, after studying the issue for many years, the U.S. Securities and Exchange Commission has finally released its long-awaited proposal to require companies to disclose their climate risks to investors. These proposed rules (neatly summarized in a 506 page notice) will require all publicly traded companies to disclose both their greenhouse gas emissions and the risks that climate change poses to their businesses. Needless to say, this is long-overdue action could have meaningful impacts on the ability of investors to direct their funds to companies that are working hard to minimize their climate footprint and are arguably the most significant action on climate change yet under the Biden administration.

Up until now, there has been no legal basis requiring companies to report on climate. There have been a barrage of voluntary initiatives, most notably from the initiative launched by Michael Bloombert, the Task Force on Climate-Related Financial Disclosure (which several countries have adopted) and from the UN Principles for Responsible Invesment, that have been working to pressure companies to voluntarily disclose data about their activities and their impacts. But, if this SEC rule does go into effect, it will be the first time that publicly traded businesses will be required to measure and disclose greenhouse gas emissions in a standardized fashion and it will have a significant impact on markets.

Up until now, there has been no legal basis requiring companies to report on climate. There have been a barrage of voluntary initiatives, most notably from the initiative launched by Michael Bloombert, the Task Force on Climate-Related Financial Disclosure (which several countries have adopted) and from the UN Principles for Responsible Invesment, that have been working to pressure companies to voluntarily disclose data about their activities and their impacts. But, if this SEC rule does go into effect, it will be the first time that publicly traded businesses will be required to measure and disclose greenhouse gas emissions in a standardized fashion and it will have a significant impact on markets.

SEC Commissioner Allison Herren Lee called it a “watershed moment for investors and financial markets.” It is also a win for President Joe Biden, whose other climate efforts have struggled. A year ago, Biden appointed Gary Gensler as his SEC chairman, and he supports the SEC’s proposed climate disclosures “because, if adopted, it would provide investors with consistent, comparable, and decision-useful information for making their investment decisions and would provide consistent and clear reporting obligations for issuers.Chairman Gensler went so far as to release a video on Twitter with him explaining why the SEC believes that requiring climate disclosures are part of the bread and butter of the SEC’s job as a regulator.

Besides the underlying and obviously urgent need for climate action, there were also considerable stakeholder risks associated with lack of uniform reporting information from companies. Notably, the issue of corporate “greenwashing” has risen in importance, as an increasing number of companies make specious claims of being sustainable, while doing everything to limit their accountability on emissions. The SEC was clearly aware that the lack of standardized reporting on material factors relating to climate risks deprived investors with information they need to make good decisions and exposed stakeholders to both the actual risks that climate change may pose to their investments and to “feel good” manipulation that prevents them from acting on those risks.

In March, 2021, SEC Acting Chair Allison Herren Lee opened up a comment period for public input on climate change disclosures. The SEC posed fifteen questions and asked the public to provide input and support for their views on how the SEC could best regulate climate disclosures that would not put undue burden on companies but which would meet the needs by investors to understand the specific risks to each business. The SEC has received 5,876 responses as of April 2022 and it is still accepting more responses. (You can click the response link and read everyones’ responses, if you wish.) Now, the SEC has opened up a new comment window on the proposed rule.

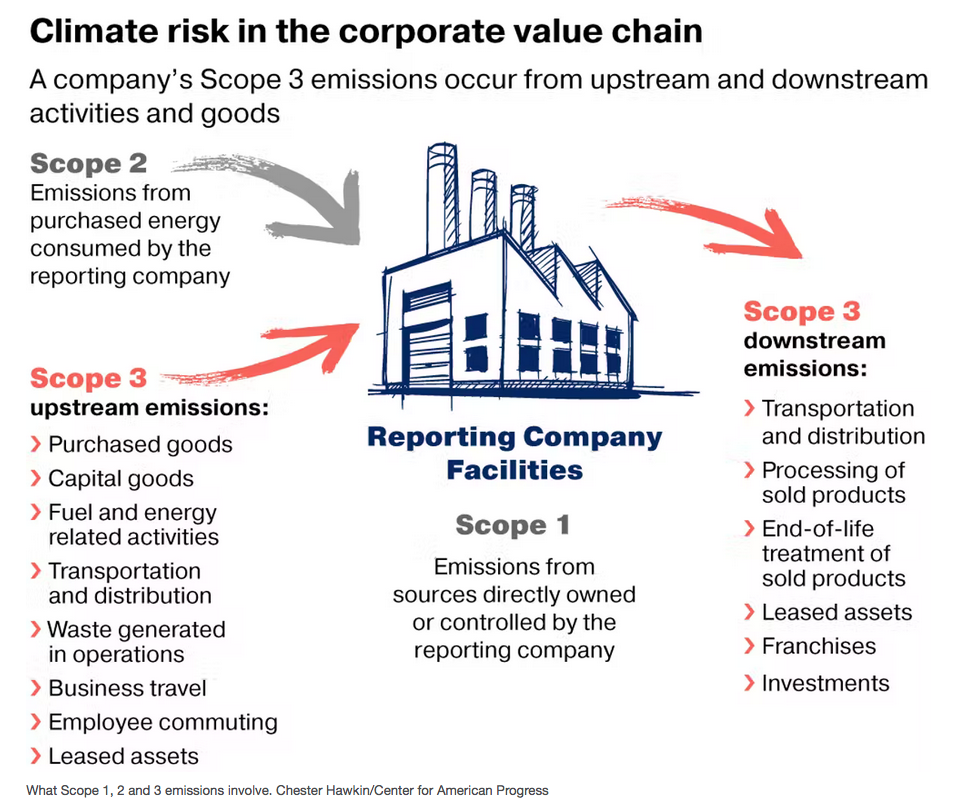

While the SEC’s rule is significantly less stringent that the European Union’s regulations, the proposed rule was well received and widely praised as a good start for the SEC from a wide array of climate-concerned investors. Under the rule as proposed, all registered companies would be required to disclose their own direct greenhouse emissions, such as emissions from manufacturing processes (Scope 1), as well as indirect emissions through the use of energy Scope 2), only some companies would need to report Scope 3 emissions under the proposal, exempting “small reporting companies” and allowing large companies to withhold Scope 3 emissions data when the company determines that the data are not “material” to investors or if the company doesn’t have Scope 3 emissions targets or goals.

Scope 3 reporting has been hotly contested, with public interest groups wanting Scope 3 reporting even from smaller companies and non-material emissions and fossil fuel groups opposing such reporting since, “hey, they only sell the carbon-emitting products, they don’t force others to use it.” Fortunately, the SEC produced an acceptable compromise there.

Leave A Comment